Real-Time Finance Transforming the Sector

How real time software processing is transforming the financial sector – How real-time software processing is transforming the financial sector is a topic of significant interest, with its impact on high-frequency trading, payment systems, and overall operational efficiency. This transformative process is rapidly reshaping financial institutions, offering opportunities for increased revenue, enhanced customer experiences, and streamlined operations. Real-time processing allows for near-instantaneous transactions, enabling faster response times and more accurate data analysis.

This process also presents challenges in terms of system integration, data security, and regulatory compliance.

The increasing reliance on real-time processing has led to innovative architectures and the adoption of technologies like low-latency networks and cloud computing. This evolution is driving the development of more sophisticated financial products and services. From fraud detection to risk management, real-time processing is crucial in today’s dynamic financial landscape. Future trends include the integration of emerging technologies like blockchain and AI, which promise even greater potential for personalized financial services.

Real-time Processing in Financial Transactions: How Real Time Software Processing Is Transforming The Financial Sector

Real-time processing is revolutionizing the financial sector, enabling faster, more efficient, and often more profitable transactions. From high-frequency trading to automated payment systems, the speed and accuracy of real-time processing are crucial for maintaining market stability and competitiveness. This rapid processing is made possible by sophisticated technologies, including advanced algorithms, high-speed networks, and robust security measures.

Real-time Processing in High-Frequency Trading

High-frequency trading (HFT) relies heavily on real-time data processing. HFT algorithms analyze market data in milliseconds, identifying and exploiting fleeting arbitrage opportunities. These algorithms execute trades at breakneck speed, often employing sophisticated strategies to react to micro-movements in market prices. The speed of these transactions is critical, as even a fraction of a second can determine the profitability of a trade.

Real-time processing enables HFT firms to capitalize on these fleeting opportunities. The complex calculations involved in algorithmic trading, combined with the need to react in milliseconds, demand the utmost efficiency and speed from the underlying infrastructure.

Types of Financial Transactions Benefiting from Real-time Processing

Numerous financial transactions benefit from the speed and efficiency of real-time processing. These include stock market orders, payment systems, foreign exchange transactions, and certain types of derivative trades. The ability to process transactions instantly is vital in these areas, allowing for quicker responses to market changes and more accurate price discovery. This is especially critical in high-volume markets where speed is paramount.

Comparison of Real-time and Batch Processing

| Transaction Type | Real-time Processing Time | Batch Processing Time | Real-time Error Rate | Batch Processing Error Rate |

|---|---|---|---|---|

| Stock Market Orders | Milliseconds | Minutes to hours | Negligible | Potentially higher |

| Payment Systems (e.g., wire transfers) | Seconds | Days | Very low | Lower, but not as low as real-time |

| Foreign Exchange Transactions | Milliseconds | Hours | Negligible | Potentially higher |

The table above highlights the significant difference in speed and efficiency between real-time and batch processing. Real-time processing allows for almost instantaneous transaction execution, while batch processing typically takes longer. The error rates also differ, with real-time processing aiming for near-zero errors due to its immediate nature. In contrast, batch processing might incur higher error rates due to the delayed nature of data aggregation and validation.

Security Measures in Real-time Processing

Robust security measures are essential to protect sensitive financial data during real-time processing. These measures include encryption of data in transit and at rest, intrusion detection systems, multi-factor authentication, and regular security audits. Security protocols must be constantly updated to counter evolving threats and vulnerabilities. Data breaches can have devastating consequences for financial institutions, including reputational damage and significant financial losses.

Strong security measures are paramount to maintaining the integrity of the financial system.

The Role of Low-Latency Networks

Low-latency networks are critical for enabling real-time financial processing. These networks minimize the time it takes for data to travel between different points in the system, enabling the rapid execution of trades and transactions. The lower the latency, the faster the processing, which is crucial for high-frequency trading and other real-time financial applications. A delay of even a few milliseconds can impact the profitability of trades or the timely completion of transactions.

The speed and reliability of low-latency networks are essential to the stability and efficiency of modern financial markets.

Impact on Financial Institutions and Operations

Real-time processing is revolutionizing the financial sector, fundamentally altering how financial institutions operate and interact with customers. This shift empowers institutions to make faster, more informed decisions, leading to improved efficiency and enhanced customer experiences. The benefits extend beyond immediate gains, impacting long-term strategies and market positioning.Financial institutions are experiencing a paradigm shift in how they conduct operations.

The instantaneous nature of real-time processing allows for immediate updates to account balances, transaction confirmations, and market data feeds. This agility translates into faster settlement times, reduced operational costs, and improved decision-making across all departments.

Benefits of Real-Time Processing for Financial Institutions, How real time software processing is transforming the financial sector

Real-time processing offers significant advantages for financial institutions, enabling them to enhance revenue streams and customer satisfaction. Immediate transaction processing allows for faster fund transfers, leading to increased operational efficiency and reduced processing delays. This efficiency translates directly to reduced operational costs, freeing up resources for other strategic initiatives.

- Increased Revenue Opportunities: Real-time processing facilitates quicker responses to market fluctuations, enabling institutions to capitalize on arbitrage opportunities and execute trades with greater precision. This ability to react instantly to dynamic market conditions improves trading strategies and boosts profitability.

- Improved Customer Experience: Instantaneous access to account information and transaction confirmations enhances the customer experience. Customers appreciate the speed and reliability of real-time updates, fostering trust and loyalty. Faster transaction processing minimizes customer wait times, which leads to greater customer satisfaction.

Impact on Operational Efficiency

Real-time processing significantly impacts the operational efficiency of financial institutions. By eliminating delays associated with batch processing, institutions can streamline operations, reduce errors, and optimize resource allocation.

- Reduced Processing Delays: Eliminating batch processing significantly reduces the time taken for transactions to be processed. This acceleration allows for quicker settlement times, faster reconciliation, and streamlined workflows. The reduction in delays leads to increased efficiency throughout the institution.

- Improved Risk Management: Real-time data feeds allow for instantaneous monitoring of market conditions and potential risks. This facilitates proactive risk management, allowing institutions to identify and mitigate potential issues before they escalate. This proactive approach is critical in maintaining financial stability and mitigating potential losses.

- Enhanced Fraud Detection: Real-time transaction monitoring allows for the rapid identification of fraudulent activities. By analyzing transactions in real-time, institutions can detect anomalies and suspicious patterns, significantly reducing the potential for fraudulent transactions and protecting customer funds.

Challenges in Implementing Real-Time Processing Systems

Implementing real-time processing systems presents several challenges for financial institutions. Careful consideration and robust strategies are required to successfully integrate and maintain these systems.

- System Integration: Integrating real-time processing systems with existing legacy systems can be complex and time-consuming. Data migration, system compatibility, and workflow adjustments often require significant effort and resources.

- Data Security: Protecting sensitive financial data in a real-time environment is paramount. Robust security measures are critical to safeguard against data breaches and cyberattacks, maintaining the confidentiality, integrity, and availability of financial information.

- Regulatory Compliance: Real-time processing systems must comply with all relevant regulations and guidelines. Strict adherence to regulations is crucial to avoid penalties and maintain the institution’s reputation.

Different Architectures for Real-Time Processing

Several architectures are used for real-time processing in financial institutions. The choice of architecture depends on the specific needs and resources of the institution.

- Microservices Architecture: This architecture allows for the modular development and deployment of real-time processing components. This modularity improves flexibility and scalability, enabling institutions to adapt to changing business requirements more easily.

- Message Queuing Systems: These systems provide a reliable mechanism for asynchronous communication between different components of a real-time processing system. Message queuing allows for decoupling of components, enhancing flexibility and resilience.

- Event-Driven Architecture: This architecture leverages events to trigger actions and responses in real-time. Event-driven systems enable institutions to react to changes in real-time, enabling faster responses and improved decision-making.

Real-Time Processing and Fraud Detection/Risk Management

Real-time processing enhances fraud detection and risk management by enabling institutions to monitor transactions in real-time.

- Fraud Detection: Real-time transaction monitoring allows for the identification of unusual patterns and anomalies that may indicate fraudulent activity. This capability allows for quicker response times, reducing the potential for losses.

- Risk Management: Instantaneous access to market data and transaction information allows for proactive risk management. Institutions can identify potential risks and implement mitigation strategies in real-time, preventing potential losses and maintaining financial stability.

Future Trends and Innovations

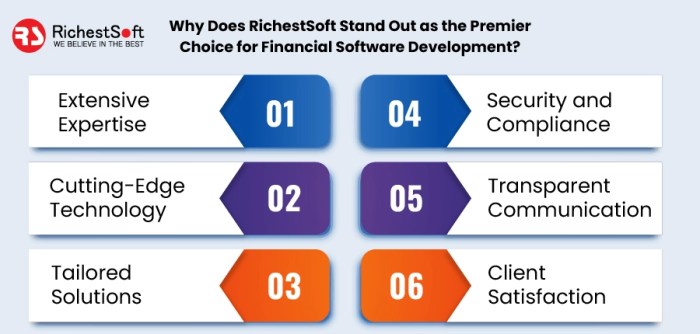

Source: richestsoft.com

Real-time processing is not just a current necessity in the financial sector; it’s a catalyst for innovation. The next phase of this evolution is fueled by emerging technologies, pushing the boundaries of speed, efficiency, and personalization in financial services. This transformation promises to reshape how institutions operate and interact with clients.

Emerging Technologies

The financial sector is leveraging advanced technologies to enhance real-time processing capabilities. Blockchain technology, known for its decentralized and secure nature, is increasingly integrated into financial transactions. This facilitates faster and more transparent settlements, reducing the risk of fraud and errors. Artificial intelligence (AI) is also playing a crucial role, automating tasks, improving risk assessment, and enabling sophisticated fraud detection.

The ability of AI to analyze vast datasets in real-time allows for more accurate predictions and proactive risk management.

Personalized Financial Services

Real-time processing empowers financial institutions to offer personalized financial services. By continuously monitoring account activity and market trends, institutions can provide tailored recommendations, optimized investment strategies, and proactive alerts. For example, a real-time system could immediately adjust an investment portfolio based on changing market conditions, potentially maximizing returns and minimizing losses. This personalized approach allows for a more dynamic and responsive financial experience for customers.

Cloud Computing Transformation

Cloud computing is revolutionizing the implementation of real-time processing systems in financial institutions. Cloud-based platforms offer scalability, flexibility, and cost-effectiveness, allowing institutions to adapt to fluctuating demands and rapidly deploy new functionalities. The ability to access and process data from anywhere, at any time, enhances collaboration and responsiveness across teams and departments. Furthermore, the enhanced security measures of cloud environments often surpass on-premises solutions, protecting sensitive financial data.

Future Developments in Real-Time Processing

The future of real-time processing is characterized by continuous innovation. The following table highlights potential developments and their impact on financial institutions.

| Technology | Application | Benefits |

|---|---|---|

| Blockchain | Cross-border payments, supply chain finance, securities trading | Increased transparency, reduced settlement times, enhanced security |

| AI | Fraud detection, risk management, algorithmic trading | Improved accuracy, faster decision-making, reduced operational costs |

| Internet of Things (IoT) | Smart contracts, real-time asset tracking, automated settlements | Enhanced efficiency, improved visibility, reduced operational costs |

| Quantum Computing | Complex risk modelling, advanced data analytics, high-frequency trading | Potential for exponential speed improvements in calculations and data processing |

Innovation in Financial Products and Services

Real-time processing is driving innovation in financial products and services. For example, the ability to process transactions in real-time has enabled the development of innovative payment systems, such as near-field communication (NFC) payments. This rapid processing translates to quicker and more convenient transactions, impacting retail banking, and impacting the way consumers manage their finances. Furthermore, real-time data analysis enables the development of new financial instruments and products that cater to evolving customer needs.

Real-time access to market data allows for dynamic pricing and hedging strategies, leading to more competitive and efficient financial markets.

Last Point

Source: org.uk

In conclusion, the transformation of the financial sector by real-time software processing is a significant and ongoing evolution. The speed and efficiency of real-time processing are revolutionizing how financial institutions operate, impacting everything from transaction speed to fraud prevention. While challenges exist, the benefits are clear, leading to improved customer experiences, increased revenue, and greater operational efficiency. The future of finance is undoubtedly intertwined with the continued development and adoption of real-time processing technologies.